Short-term lending has exploded in popularity as businesses and consumers look for fast, flexible access to capital. But with speed comes risk, and lenders must balance growth with careful oversight. The best way to do this is by tracking the right key performance indicators (KPIs).

By carefully measuring key metrics, lenders can assess portfolio health, optimize decision-making, and reduce exposure to bad debt. In this article, we’ll break down the most important KPIs short-term lenders should monitor.

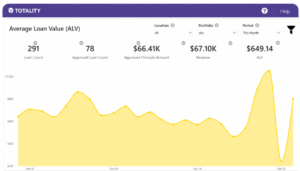

This measures the typical size of the loans being disbursed. Tracking average loan value helps lenders understand borrower demand and risk appetite.

A consistently high average loan value may indicate more profitable customers, but it also comes with higher risk. Conversely, a lower average loan value can diversify exposure but may require higher loan volumes to maintain profitability.

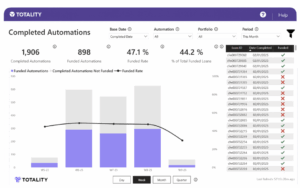

The funded rate shows the proportion of loan applications that are actually funded. It reflects both the quality of applicants and the efficiency of the underwriting process.

A low funded rate might suggest strict approval standards or friction in the lending process, while a high funded rate could point to broader credit criteria or efficient applicant targeting. But higher doesn’t always mean better — funding too many applications too easily can increase delinquency risk and reduce overall portfolio quality. The most successful programs find the sweet spot: funding at a rate that fuels growth while protecting against unnecessary risk.

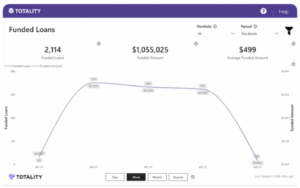

Breaking down loans as a percentage of the total portfolio helps lenders identify which loan products or borrower segments dominate.

This KPI offers insights into diversification and concentration risk. For instance, if one product type accounts for a disproportionately high share, lenders may need to rebalance their portfolio.

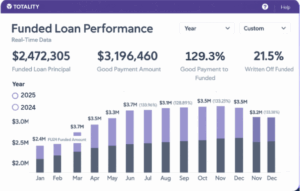

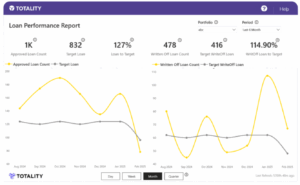

Once loans are funded, tracking their performance over time is critical. This KPI highlights repayment behavior, delinquency trends, and whether borrowers are meeting their obligations.

Consistently strong performance signals healthy underwriting practices, while poor performance may require policy adjustments.

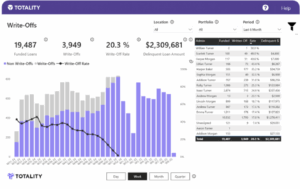

Write-offs indicate loans that are deemed uncollectible. Monitoring this KPI is essential for evaluating the cost of risk.

A rising write-off trend can highlight weaknesses in credit assessment or repayment collection processes and must be managed carefully to protect profitability.

This KPI tracks the total value of loans past due but not yet written off. Delinquencies serve as early warning signs, giving lenders the opportunity to intervene through collection strategies or borrower support before loans are permanently lost.

While each KPI provides valuable insights on its own, the real power lies in tracking them together. Totality allows lenders to see how loan origination, funding, and repayment dynamics connect to overall risk and profitability.

For example, high funded rates paired with rising delinquency amounts could indicate that underwriting criteria need to be tightened. Similarly, trends in average loan value combined with write-off data can inform product adjustments. By evaluating these KPIs in Totality, lenders gain a complete picture of their lending performance and portfolio health.